Active Jobs: A 2022 Overview

Outlook on Active White Collar Job Openings – India

October Rising:

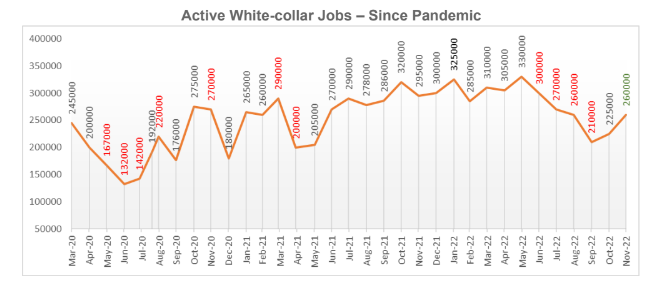

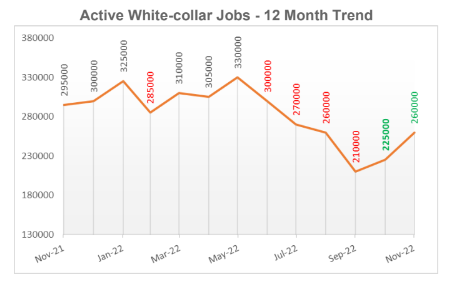

Active jobs in 2022 have been very low, but October brought some signs of hope. Compared to October 2021, the number of active jobs in October 2022 was 30% lower. In fact, October 2022 had the second-lowest number of active jobs this year. The lowest number was 210,000 in September 2022.

This was the first positive movement in over 5 months. The number of active jobs in October was 225,000, compared to 210,000 in September. However, In October 2022, the number of active jobs increased by 7% compared to September 2022.

October 2021 had one of the highest numbers of active jobs over the last two years. Despite a slight increase in October 2022, the average number of active jobs for the current fiscal year remains below 280,000 per month. October’s numbers also ended the longest slide in active jobs since March 2020.

By Sector-wise

All tech sectors, including services, products, and startups, saw a decrease in active job openings in October 2022. Tech startups saw the biggest decrease, at 15% compared to September.

Tech hiring has been affected by rising inflation concerns and companies are reviewing their hiring plans for the end of the year.

The IT Services sector had a 14% decrease in active job openings in October 2022, its lowest number in 22 months, with a total of 60,000 active openings. This was a 50% decrease compared to August 2021.

On the other hand, the BFSI sector saw a 24% increase in active job openings. Other non-tech sectors remained stable and made up 44% of active jobs in October 2022. This means that active Jobs in non-tech sectors are now the majority.

The IT Services sector has been decreasing in volume for the last 8 months. As a result, the IT Services sector’s contribution to tech jobs dropped below 30% for the first time in over 20 months. The sector’s contribution was 27%, which means that it lost its dominant position in talent consumption.

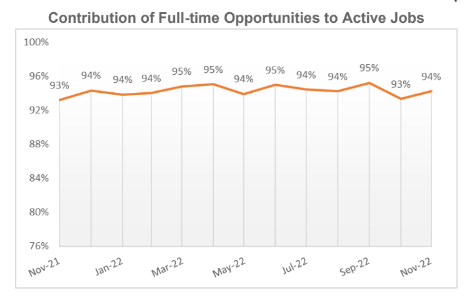

By Job Type:

In October 2022, the number of full-time job openings increased by 5% to reach 210,000. Part-time and internship job openings stayed the same, but contract job openings increased by 50%. Most job openings were full-time, making up 93% of all job openings. The non-tech industry helped increase the number of full-time job openings. This was the second-lowest number of full-time job openings in the 17 months since May 2021.

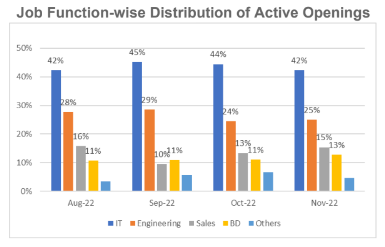

By Job Function:

Job openings by key functions registered movements in volume. Some went down by 8%, while others went up by 50%. Sales & BD openings grew by 30% over the volume as seen in September 2022. IT Function increased by 5% in October 2022. Engineering openings shrunk by 8% over September 2022. IT function remained high with an overall contribution of 44%.

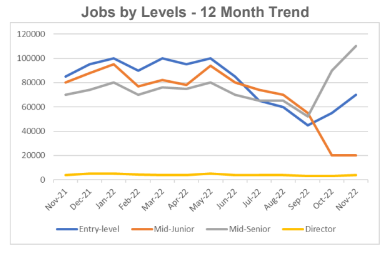

By Job Level:

Entry-level openings in October 2022 recovered and grew by 22% in volume to close at 55,000, as against 45,000 in September 2022. While Mid-Junior level openings shrunk the most by 64%, Mid-Senior level openings recovered by 73%. Senior-level openings maintained the same volume as seen in September 2022.

By Industry:

- IT Services and Software Service sectors registered drops by 14% and 8% respectively. The IT Services sector saw a 14% decrease compared to the previous month and a 50% decrease compared to October 2021. The Software Service sector saw an 8% decrease compared to the previous month. Additionally, the internet-enabled services and startup sector experienced a 15% decrease in job openings, with 11,000 openings in October 2022 compared to 13,000 in September 2022.

- Along with the drop of 14% in volume over the previous month, the IT Services sector also closed 50% lower than in October 2021. On a YoY basis, IT Services registered their steepest drop of 50% in volume over the same period last year.

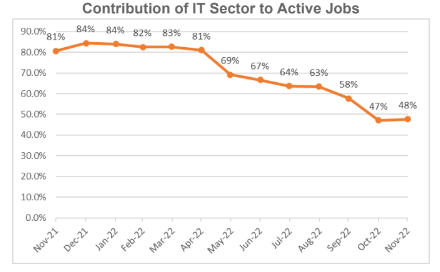

- Overall, the IT Sector Collective, which includes the IT Services, Products, and internet-enabled sectors, saw a 12% decrease in job openings compared to the previous month. The collective put out 106K jobs in October 2022, as against 121K in September 2022. This is the lowest number of active job openings from the IT Sector Collective in over 28 months.

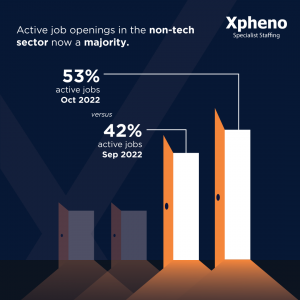

Active Jobs in non-tech sectors are now the majority:

- The IT Sector’s overall contribution to active openings dropped below 50% for the first time in 3 years. Previously, the tech sector had held a dominant position with over 80% of active job openings. With the drop below 50%, the Tech sector lost its position as the primary hiring sector for white-collar openings.

- As seen over the last 8 months, the drop in numbers from the tech sector has been compensated by the non-tech sectors that continue to put out consistent active job volumes. The non-tech sector jobs contributed to 53% of the overall Active Jobs in October 2022 as compared to 42% in September 2022.

- The festive end of the Year saw hiring action rising in Non-Tech sectors, while the Tech sector reeled under the threat of recession and dropping tech spending. Sectors like Hospitality & Tourism, Manufacturing, Healthcare, Automotive, Oil & Energy, Media & Advertising, and Telecom continue to put out active openings and make up for the drop in numbers from the Tech Sector. Other sectors like Telecom, Education, Pharma, Logistics & Supply Chain continue to contribute by adding more active openings.

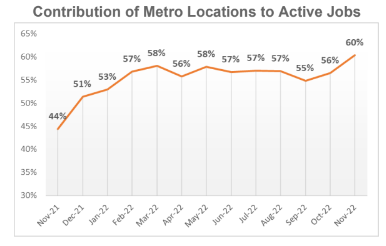

By Location

The top five metropolitan areas continued to dominate the job market, offering 56% of active job openings. This is the third-highest contribution from these areas in the last two years. The top five metros offered over 127,000 active job openings, representing a 10% increase from the previous month. However, this was also a 16% decrease from the same period the previous year.

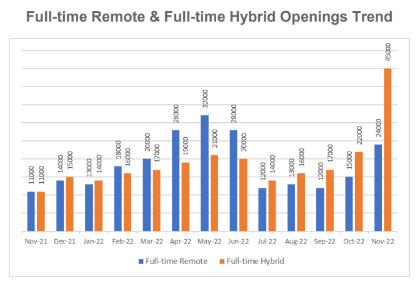

By Engagement Format:

In October 2022, there were 15,000 full-time remote job openings, compared to 12,000 in September. There were also 22,000 full-time hybrid job openings in October, compared to 17,000 in September. In total, job openings that allowed people to work remotely or in a hybrid mode made up 16% of all job openings in October, up from 14% in September.

The Upshot:

The number of active job openings increased by 7% in October 2022, which stopped the decline in job openings that had been happening for the past five months. This is the start of a recovery in the job market that is expected to continue for the rest of the fiscal year. However, the recovery is not expected to be sudden but rather will happen slowly over 6 to 8 months.

The tech industry’s dominance in job openings is decreasing due to a slowdown in hiring and changes in hiring plans for large tech companies. Hiring in the non-tech sector is increasing, especially at the end of the year. The tech industry is expected to start hiring again in early 2023.