Insights Into the Early-Stage Startup Funding Landscape in India

India’s startup environment has been bustling over the past decade. Government’s support, interest from angel investors and availability of venture capital investment has helped startups grow quickly. Some of them have worked their way up to become unicorns.

This success in the startup ecosystem led to a surge in innovative ideas, entrepreneurial spirit and investor interest. This further grew the startup sector. One crucial aspect of this ecosystem is early-stage startup funding, which plays a pivotal role in helping startups bring their ideas to life and scale their businesses.

In this article, we will delve into the early-stage startup funding landscape in India, exploring key insights, trends, and factors that influence funding decisions.

Table of Contents

Early Deals in India

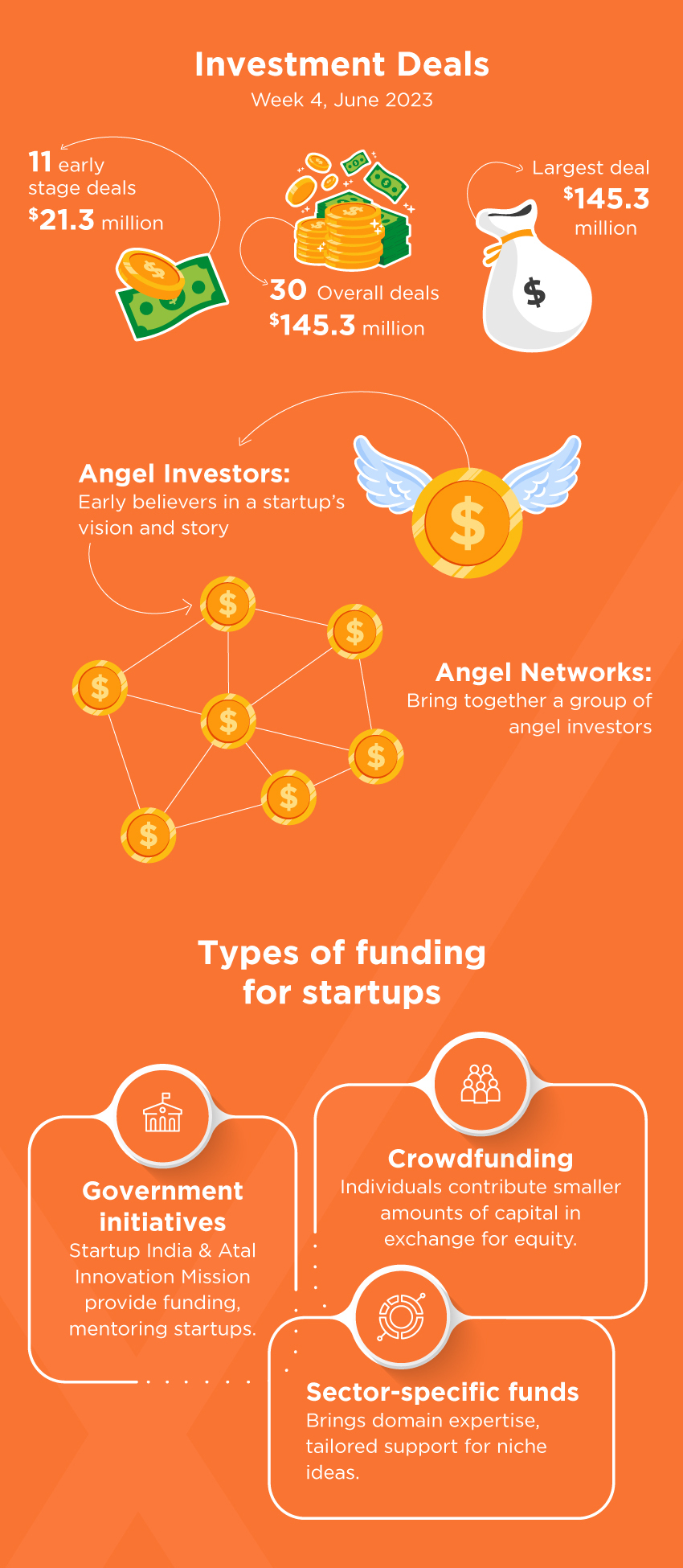

Xpheno Specialist Staffing has been compiling early stage startup deals in India on a weekly basis along with notable series A funding rounds. In the last week of June 2023, we have had 11 early stage deals with a declared value of $21.3 millions and 30 overall deals with a declared value of $145.3 millions, with the largest deal being worth $61 millions. Here goes some major factors and trends that are influencing investor decisions in India.

Growing investor interest

Over the past decade, there has been a significant increase in investor interest in Indian startups. Both domestic and international investors are actively seeking promising early-stage ventures to invest in. Venture capital firms, angel investors, corporate investors, and government initiatives are contributing to the funding landscape. While angel investors provide seed funding and early-stage investments, venture capitalists bring the money for developing the startup. The government, for its part, supports all startup activity with two key initiatives: Startup India and Make In India.

Rise of angel investors and angel networks

Angel investors are high-net-worth individuals who provide seed funding and mentorship to startups. They have played a crucial role in supporting early-stage ventures. Additionally, angel networks, which bring together a group of angel investors, have emerged, facilitating a more organized approach to startup funding.

Typically, angel investors are the early believers in a startup’s vision and story. They are also the first risk takers. Most angel investors go by the promoters’ passion and vision. They also bet on the startup’s product and its ability to disrupt and conquer the market.

Angel investments are usually small in value but are crucial for a startup’s survival and growth in the nascent years.

Accelerators and incubators

Accelerator and incubator programs have gained prominence in India, offering startups mentoring, networking opportunities, and seed funding in exchange for equity. These programs help startups refine their business models, connect with industry experts, and gain access to a supportive ecosystem.

Accelerators and incubators are designed to help startup businesses by offering them access to potential partners, investors and customers. Some accelerator and incubator programs offer office space and on-the-job mentorship.

Government initiatives

The Indian government has taken several initiatives to boost the startup ecosystem and early-stage funding. Programs such as Startup India and Atal Innovation Mission provide funding, mentoring, and policy support to startups, fostering innovation and entrepreneurship across the country.

Startup India was launched in 2016 to nurture and develop the startup ecosystem in India. Apart from providing funding and incubation support to startups, the program also offers a favorable regulatory environment for startups to grow and flourish.

Sector-specific funds

Investors and funds are increasingly focusing on specific sectors, such as technology, healthcare, fintech, and e-commerce. These sector-specific funds bring domain expertise and tailored support to startups operating in those industries, making funding more accessible for entrepreneurs with niche ideas.

Sector-specific funds are usually led by aggressive investors. Due to the nature of the investment being focused only on niche sectors, such funds are considered risky by the rest of the players in the market. But these funds are a huge blessing for startups that have a growth strategy that’s focused on specific sectors.

Rise of crowdfunding

Crowdfunding platforms have gained popularity as an alternative means of early-stage funding. Startups can showcase their ideas and products to a wider audience, allowing individuals to contribute small amounts of capital in exchange for rewards or equity.

Crowdfunding supports three types of initiatives: It helps innovators launch ideas, startups raise money and social entrepreneurs reach key market segments to make a difference.

Startups, in particular, like crowdfunding. The way the crowdfunding platforms help raise money is simple. Angel investments are often complex and have a longer gestation period. Whereas, a crowdfunding idea can take off almost seamlessly once the startup has chosen a crowdfunding platform.

Due diligence and investor expectations

Investors in early-stage startups conduct thorough due diligence before making funding decisions. They evaluate factors such as market potential, scalability, team strength, and competitive advantage. Startups need to demonstrate a clear vision, a viable business model, and a solid execution plan to attract investors.

Due diligence is often an elaborate process. Right from the vision of the promoters to their values and roadmap for the startup’s growth, everything in the company is evaluated by investors. A key aspect of due diligence is how the evaluators or assessors pay attention to detail – often to what is not stated or disclosed. Investors usually want to work with ethical promoters – not just to secure their money, but also to ensure that the startup will grow and live up to its promise.

Series A crunch

While early-stage funding has seen significant growth, there is still a gap when it comes to Series A funding. Many startups face challenges in securing the next round of funding to scale their operations. It emphasizes the importance of early-stage startups focusing on achieving key milestones and demonstrating market traction to secure subsequent funding rounds.

The Series A crunch is a widely-prevalent phenomenon in the startup ecosystem. When a startup fails to secure its initial funding it has to either pause operations or change its growth trajectory or, in some cases, wind up. One reason why a Series A crunch strikes a startup is that there are many startups that are vying for the same pool of funds. Creating a powerful pitch and a compelling storyboard can help a startup avoid a Series A crunch.

Conclusion

The early-stage startup funding landscape in India has evolved rapidly, creating a conducive environment for entrepreneurs to turn their ideas into successful ventures. With the rise of angel investors, incubators, government initiatives, and sector-specific funds, startups have access to both mentorship and money.

Yet, no matter how much money a startup receives or how many mentors it has advising it, what matters most is the integrity of the startup’s core idea – its product or service. Only startups with integrity will eventually survive, thrive, grow and contribute.